How to Save Money to Go on a Trip?

If you’re wondering how to save money to go on a trip, this blog is for you!

The good thing is that you don’t have to be wealthy to travel. That’s right, don’t expect to win the lottery or inherit a fortune.

We’re here to show you that with a dash of discipline, creativity, and determination, you can save money and go on your dream vacation.

In this blog, we’ll reveal the secrets of budget travel, showing you how to make your dream trip a reality without breaking your bank account.

We’ll share helpful hints, clever hacks, and innovative strategies to help you stretch your dollars and cents and experience the world on your own.

So, let’s get started and make your travel dreams a reality!

Set the intention of your trip.

Having a clear vision of what you want to accomplish on your trip can help you plan how to save money on travel.

For example, if you plan a cultural immersion trip, you can prioritize saving for immersive activities, local guides, or language classes.

Or, if you want to explore natural wonders, you can save money for outdoor activities, national park fees, or rental cars for a more enjoyable experience.

Travel to locations where your home currency is more valuable.

When your home currency is stronger than the local currency, your money will go further, and you can enjoy more for less.

Travelers can get the most for their buck in Vietnam, Thailand, Mexico, and Portugal.

Compared to more expensive regions, choosing these destinations can result in lower lodging, meals, transportation, and activities costs.

These luxuries might not be affordable if they traveled to more expensive regions such as Northern Europe, the USA, or Japan.

Consider researching countries where your own money saved up can make a bigger difference and exploring the diverse cultures, beautiful landscapes, and fascinating history while keeping your wallet in mind.

It’s a practical way to have unforgettable adventures while staying within your savings goal.

Also, don’t forget to use a credit card with no foreign transaction fees and keep currency conversions in mind.

Believe that you can do it and see your wishes come true!

By clarifying your intention, you gain a clear vision of what you like to achieve and the financial commitment needed.

Take on Financial Responsibility.

It’s amusing how the school doesn’t teach us much about financial planning.

We are frequently clueless about money management once we become adults, and even then, it is a learning process.

But now is a great time to go back to basics and work on some bad financial habits we’ve picked up.

Saving enough money for travel (or anything else) can be difficult and requires a lot of dedication and sacrifice.

That is most likely why not everyone succeeds.

However, the right mindset is everything!

So, ask yourself how badly you want this because you’re in charge of making it happen.

It’s your journey, and you have complete control.

It is okay to try and fail. Learning the right habits and strategies to save the necessary amount may take a few tries, which is perfectly fine.

But the good thing is that you’re up to the challenge.

That’s why you’re looking for a useful tip on how to save money to go on a trip.

Remember that it won’t always be easy, but with determination and the right mindset, you’ll get there!

Monitor Your Expenses.

Saving money isn’t stressful in and of itself, and effective money management is entirely achievable.

But what if you don’t know what your money is doing?

That is when the stress begins, and we need to address that.

Set aside some spare time this weekend, and go through your bank account thoroughly.

Make a list of every single penny you spend each month. Yes, every detail matters!

Did you know your daily corner store snacks or coffees can add up to $5-$10 daily?

That’s $150-$300 per month that could be put toward your travel fund instead.

Isn’t it alarming how money can slip away? With that, you might want to read money mistakes to avoid them.

It might be intimidating to write everything down. But it would be best if you face it to move on.

Calculate your weekly food spending, including groceries, eating out, bottled water, and snacks.

Consider your entertainment costs, such as movie tickets, books, music, and sports tickets.

Not to mention vices such as alcohol, cigarettes, and coffee.

What about your monthly bills?

Rent, utilities, mortgages, car payments, insurance, credit card interest, cell phone service, gym membership, student loans—it all needs to be recorded.

And random shopping, video games, and new clothes count as well!

Now, take a deep breath and face reality.

You may be surprised that there’s too much money you actually spend.

Little money has a habit of sneaking up on you.

But here’s another useful tip: saving with the right mindset makes all the difference.

As with any habit, developing this awareness and tracking everything takes time.

You cannot change your behavior overnight.

But believe me when I say that you’re getting closer to your savings goals and that incredible trip you’ve been planning with each step forward!

Create a Strict Budget.

In implementing a strict budget, you must master not just one but two kinds of budgeting here: the travel budget and your daily budget.

First, let’s talk about budgeting for your trip.

Given that you set your intention, you can begin by calculating the costs of going to your chosen place and estimating how much money you’ll need each week.

Consider local transportation, hotel stays, delectable food and beverages, and the leisure activities you can’t wait to try.

Once you’ve determined how much money you’ll need, it’s time to review your monthly budget (or develop one if you haven’t already).

Examine your income and costs to determine how much money you can set aside monthly for your trip fund.

Don’t worry if it appears that you will need more money.

That’s where this guide becomes handy!

So, read on, and you’re one step away from reaching your dream trip!

Lower Accommodation Expenses.

If you have a strong desire to travel but are restricted by a mortgage, let’s look at some friendly options to help you save money.

Selling your home may be a big step, but some people who chose traveling realized that being homeowners wasn’t bringing them the happiness they desired.

So they decided to sell their home.

If you are not ready to sell, there are still options to consider.

Have you considered renting out your place for a year or so?

Many people have successfully sublet their homes while building equity and traveling full-time.

They choose to rent in other areas rather than return home and are content with their new nomadic lifestyle.

Also, pay attention to platforms like Airbnb or VRBO, which can help you generate additional income from your property.

If you’re currently renting, downsizing to a smaller place in a cheaper neighborhood could be a game-changer.

Or, if you have a loving and generous family, consider staying with them for a few months.

It’s a small price to put thousands of dollars back into your pocket for travel.

And for an extreme but practical suggestion, consider taking on a roommate or two to split the rent and bills.

Although it may appear unconventional, many people have succeeded and saved significant money using this method.

Try to look at this perspective: more roommates equals less financial burden and more money in your vacation fund.

These solutions may only be ideal for some, but they are worth considering because they can open new doors and bring you closer to your travel goals.

Sometimes you have to think outside the box and be willing to go to extreme lengths to make your dreams a reality.

Sell Unwanted Items.

Selling unwanted items is one of the best ways to save money.

Examine what’s around you for things that you no longer need or use.

Clothing, electronics, furniture, and even collectibles could be included.

These items may be valuable to someone else, and selling them allows you to not only declutter your space but also increase your travel fund.

Online marketplaces such as eBay, Craigslist, Facebook marketplace, or even the local market are excellent places to sell your items.

Take clear photos, write engaging descriptions, and charge reasonable prices.

You’d be surprised how much money people are willing to pay for your stuff!

Keep in mind that one person’s clutter is another person’s treasure.

So, don’t be afraid to sell your unwanted items.

The extra money you earn can be deposited directly into your travel savings account, bringing you one step closer to your dream adventure.

Do a Meal Plan and Shop Weekly.

Sit down and decide what delicious dishes you want to cook for the next seven days.

Jot down all the ingredients you’ll need on a handy shopping list.

Don’t forget to include any other essentials while you’re at it.

Now, armed with your list, head to local grocery stores where you may find half-the-price items.

Stay strong and resist the temptation to stray from your list to avoid spending extra money.

Doing big weekly shopping will avoid unnecessary spending your saved money out of impulse.

It’s a smart way to keep your food expenses in check.

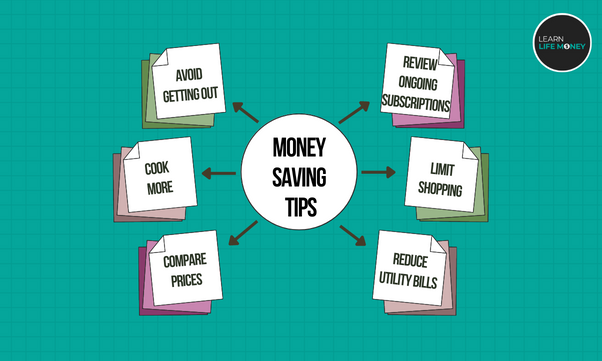

Try Other Money-Saving Tips.

10d You will need more than just creating a budget and selling your things to save hundreds.

But these minor sacrifices can significantly impact your travel budget when combined with other smart money-saving decisions.

It all comes down to embracing various lifestyle changes that increase over time and help you achieve your travel objectives.

So, while it may appear to be a minor adjustment, every small change counts and brings you closer to your savings goal, making a big difference in your savings.

Avoid Going Out.

Instead of going out to a club or the movies, why not gather your friends and have a cozy movie night at your house?

And if you want to get in touch with nature, why not go on a hike?

Hiking not only allows you to discover new scenic trails but is also free, making it an excellent way to have fun while keeping your other expenses in check.

Cook More.

Cooking at home not only saves money but also allows you to learn about the art of cooking.

You can find delicious recipes using inexpensive, healthy ingredients to make meals that satisfy your taste buds and wallet.

Compare Prices.

When shopping, compare prices and choose the most cost-effective option.

Consider Costco and online marketplaces like Amazon for potential savings on everyday items.

Review Ongoing Subscriptions.

Do you have a landline phone?

Think about whether it’s essential.

Because most people rely on cell phones, ditching your landline can save money.

Same with a television cable.

There are numerous free entertainment available online.

Consider canceling your cable subscription and finding other ways to entertain yourself.

Reduce Shopping Expenses.

When shopping, try to distinguish between your wants and your needs.

Prioritize necessities and resist the temptation to splurge on the latest gadgets, fashion trends, or beauty products.

It’s unbelievable how much money you can save by avoiding unnecessary purchases.

Lower Utility Bills.

Examine your utility bills to see any areas where you can cut back.

You can save money by adjusting the temperature, using a fan instead of air conditioning, and being mindful of your electricity usage.

Earn Extra Money.

Consider a side hustle to supplement your income in addition to cutting expenses.

There are numerous opportunities to earn some extra cash, money that can go towards your travel fund, whether working part-time at a local establishment, starting an online business, or offering your skills and services.

Explore your skills and interests, and find a suitable side hustle.

Remember that when it comes to saving money, the possibilities are limitless.

You can make significant progress toward funding your dream trip with a bit of imagination and commitment!

Assess Your Job Situation.

Assessing your current job situation is essential in determining whether you have enough money to save for your trip.

Take some time to evaluate your income, expenses, and potential savings.

Consider your salary, working hours, and opportunities for overtime or bonuses.

Examine whether your current job allows you to save a sizable portion of your income or if it barely covers your expenses (even if you have a side hustle).

If you find saving for your trip difficult with your current job, it may be worth looking into other options.

Analyze potential pay raises or promotions within your current company.

If there are opportunities for advancement that can provide a higher income, saving for your trip may become more feasible.

If that doesn’t work out, it’s time to look for a better job that recognizes your abilities and rewards you properly.

Examine whether career paths or industries align with your interests and offer higher earning potential.

I’m not going to sugarcoat it: getting a better job isn’t easy, but it’s well worth the effort to seek a more meaningful and financially rewarding profession.

In the long run, changing careers may be a more sustainable way of saving for your trip.

Plan Early.

Finding cheap flights is a practical way of saving way.

And one of the key factors in securing affordable airfare is flexibility with your travel dates.

You can take advantage of lower fares during off-peak times or snag last-minute deals by being open to different departure and return dates.

To find the best flight deals, it’s essential to be assertive and look for promotions and discounts.

Sign up for newsletters from airlines and travel websites to stay updated on special offers and flash sales.

Additionally, utilize flight search engines that compare prices across multiple airlines, enabling you to find the most affordable options for your desired destination.

When booking flights, be mindful of resort fees and additional charges that can inflate the overall cost of your trip.

Some resorts or hotels may have hidden fees that take time to be apparent.

Research and choose accommodation options that have transparent pricing structures, avoiding unnecessary expenses.

Remember, it’s not just about finding cheap flights but also the best deals on other aspects of your trip.

Many hotels offer promotions, discounted packages, or loyalty programs that can aid you in saving money on accommodations.

Take the time to research and compare prices to find the most budget-friendly options that suit your needs.

By actively seeking out and capitalizing on cheap flights and other travel deals, you can significantly reduce your overall expenses, leaving more room in your budget for memorable experiences, local cuisine, and exploring your destination to the fullest.

So, start hunting for those incredible flight deals and book your next trip as early as now!

Consider Earning Money While Traveling.

Earning money while traveling is a wise strategy for saving money for your next trip while sustaining your adventures on the road.

It covers expenses, broadens your travel experience, and opens new opportunities.

Remote work or freelancing is a popular option to earn money in which you can leverage your skills and offer your services online.

With the rise of digital nomadism, many businesses and individuals are willing to hire remote workers, allowing them to work from anywhere in the world.

This adaptability will enable you to earn a living while traveling to new places.

Earning money while traveling necessitates careful planning and adaptability, but it adds a dynamic element to your journey.

It enables you to extend your travels, gain a deeper understanding of new destinations, and alleviate financial concerns.

However, it is critical to research the legalities and requirements of working in each country you visit to ensure you comply with local regulations.

Earning money while traveling allows you to save money for future trips and create a sustainable lifestyle that helps you to continue exploring the world.

Embrace the possibilities, be open to new experiences, and maximize your travel opportunities while establishing a solid financial foundation.

Final Thoughts on How to Save Money to Go on a Trip…

That’s it! I hope you find these travel tips on how to save money to go on a trip valuable and inspiring.

As you travel, you’ll quickly realize that things sometimes go differently than planned.

But guess what? That’s all part of the fun!

The ability to think on your feet and adjust your path as you go is a valuable skill for travel and life in general.

Be prepared for unexpected obstacles.

Life has a habit of throwing curveballs; even the best-laid plans can go wrong.

But don’t let that discourage you. Stay focused on your goals and intention.

Always remember that there is always another way to get there.

The route you take is less important than the destination itself.

So, embrace the unpredictability, remain resilient, and continue to pursue your travel dreams. I wish you the best of luck, and who knows, our paths will cross as we embark on our incredible journeys!