How to Make Money From Robinhood?

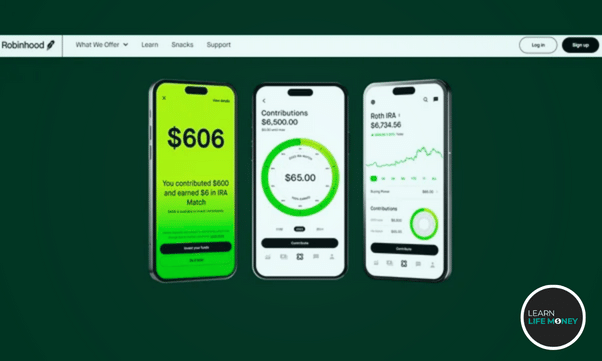

From the stock market to margin trading, Robinhood is now a well-known platform for investing.

With just a few taps, you can buy/sell stocks and ETFs in minutes right from your smartphone.

Thanks to commission-free trading, your stock price and trades won’t be affected by hefty fees.

In addition, you can also access real-time market data and sophisticated trading tools to help you make informed investment decisions.

But beyond that, you can use Robinhood to make money in the stock market in several ways.

In this article, we will share everything you need to know about how to make money with Robinhood.

We’ll cover everything from creating a free stock trading account to different ways you can increase your profits.

So if you plan to use Robinhood or already use it, this article is for you!

What is Robinhood?

Simply put, Robinhood is a commission-free stock trading platform.

It allows users to buy/sell stocks, ETFs, and cryptocurrencies without paying fees or commissions.

This makes it incredibly easy and affordable for people just starting to invest in the stock market.

You also have asset appreciation, dividend income, and other forms of passive income that you may want to consider.

Robinhood makes it easy to track your investments, analyze market trends, and decide where to put your money.

You can even research stocks on the platform with news articles, analyst ratings, and more.

With Robinhood, there are some restrictions on what you can and cannot do.

For example, you won’t be able to trade on bonds and mutual funds, but you can still invest in other stocks and ETFs.

Robinhood is also a financial industry-regulated authority.

This means your investments are safe and secure with Robinhood, even if something happens to the company or market.

You might have to pay just a few dollars in taxes on your investments, but Robinhood is still an excellent platform for making money overall.

You can easily create your brokerage account and begin investing in no time.

How Does Robinhood Work?

Just like any other stock trading platform, Robinhood requires you to open an account and add some funds.

Once you have your account set up, you can start buying and selling stocks.

Now you can track your portfolio and check the performance of different stocks.

You will have access to valuable tools and resources such as news articles, analyst ratings, and more.

This will help you stay informed about the market and make better-informed decisions about when to buy or sell.

And since Robinhood does not charge commission fees, your investments accumulate faster and can make you even more money in the long run.

You can also set up limit orders to set a price target for your investments and get notified when that goal is reached.

In addition to stock trading, Robinhood also offers options trading and cryptocurrency trading.

This allows you to diversify your portfolio and make money from multiple sources.

So whether you’re looking to trade or passively invest actively, Robinhood can be a great platform.

In general, Robinhood is an excellent platform for anyone who wants to get started in stock trading. The tools and resources make it easy to track your investments and stay informed about the market.

What Can You Trade Using Robinhood?

When it comes to investing in Robinhood, you have a lot of options. You can us it for:

- Stock Trading

- Margin Trading

- OTC Stocks

- Options Trading

- Crypto Trading

These are the assets you can trade in with Robinhood – each of these has certain advantages and risks that you need to consider before investing.

Thus, by understanding how Robinhood works and the types of assets it offers, you can make informed decisions about what to invest in and when.

With the right approach, this platform can be an excellent way to make money in the stock market.

How to Create a Robinhood Account?

Creating a Robinhood account is extremely easy and takes less than 5 minutes – here are the necessary steps to get started:

1. Visit the Robinhood website or download and open the app on your mobile device.

2. Click ‘Sign Up’ and enter personal details such as your name, email address, and phone number.

3. Create a unique username and password that you will use to log in to your account.

4. Choose the type of account you want to open and provide additional information (such as your Social Security Number).

5. Read and accept the terms and conditions and click ‘Finish’ to complete your Robinhood sign-up process.

Once your account is created, you can invest in stocks, ETFs, and other assets.

As you become more familiar with the platform, you can use tools like Robinhood’s stock screener to find stocks with excellent profit potential and create a diversified portfolio.

How Can I Make Money on Robinhood?

You must invest in stocks, ETFs, or other eligible assets to make money on Robinhood.

You can buy and sell these securities with the intent of making a profit from changes in their prices over time.

It is essential to understand how stock markets work to maximize profits, observe market trends and news developments, and stay up-to-date on company performance.

It is also essential to understand investors’ different strategies, such as day trading, swing trading, and long-term investing.

In addition to trading stocks, you can earn money through publicly traded companies’ dividends.

Dividends are payments from a company’s profits distributed to its shareholders.

You can also earn interest on cash balances in your account, depending on the type of account you have with Robinhood.

For example, when it comes to stock trading, you can buy stocks when the stock price drops and sell high when stock prices increase.

This is the most basic way to make money, but experienced traders may look for other opportunities.

Another way to make money is through options trading.

Options are contracts that give you the right to trade an asset at a future predetermined price on or before a specific date.

When trading options, investors can take advantage of changes in the market and potentially generate substantial returns.

You also have crypto-currency trading options with Robinhood.

You can trade Bitcoin, Ethereum, and other digital assets through their platform for a potential return on your investment.

In addition to these investments, you can also use the Robinhood app to access features such as automated investing and margin accounts.

You can make money on Robinhood in many ways, but it is essential to remember that investing involves taking risks and may not be suitable for everyone.

Before you begin investing, it is essential to understand the potential risks and develop an investment strategy that works best for your individual financial goals and seek help from a financial professional.

Does Robinhood Allow Commission-Free Trading?

Yes, Robinhood is 100% commission-free for stock trades.

You can buy and sell stocks, options, ETFs, and other eligible assets without incurring any trading fees.

However, certain services, such as margin or digital services, may incur additional fees.

It is essential to read the terms and conditions of your account before investing.

You don’t have to pay fees to open a Robinhood account, meaning you can make your money work for you even before you start trading.

To maximize your investments, you should consider proper asset allocation and diversification, accounting for risk tolerance and goals.

However, you can subscribe to premium services, such as Robinhood Gold, which gives you access to extra features such as valuable data and research insights – it will cost you $5 per month, however!

Can You Lose Money On Robinhood?

Yes, you can lose money on every trading platform, not just Robinhood.

It is important to remember that all investments come with risks, and it’s your responsibility to make informed decisions when trading on the app.

If you need clarification on investment or need help understanding how something works, always do more research or consult a financial adviser before making any trades.

However, if you are worried about being hacked or losing money in a scam, you can rest assured that Robinhood is a secure platform with strict security measures to protect your funds.

They also provide access to detailed educational resources to make more informed trading decisions.

Advantages of Robinhood

Let’s take a look at some of the key advantages Robinhood has to offer:

1. Trusted Platform.

Robinhood is undoubtedly one of the most trusted platforms in the world to trade stocks, ETFs, and options.

Thousands of traders use it daily, and the platform constantly improves its services to meet customers’ needs. It uses only modern and secure technology to protect your funds.

2. No Securities and Exchange Commission.

One of the main highlights of Robinhood is that it offers zero commissions for stock trades.

This means you don’t have to worry about paying fees when you trade on the platform.

Unlike other platforms, you get to keep the entire amount of any profits you make.

3. User-Friendly Interface.

Even if you are a beginner trader with zero to minimum experience, you will find the user interface of Robinhood easy to navigate.

It is designed with a modern, minimalist style and offers advanced tools such as real-time market data and charting capabilities.

In addition, Robinhood has an entire section for educational content so that you can learn the basics of investing and trading.

4. Crypto Trading.

Along with stocks, ETFs, and options, Robinhood also allows users to trade cryptocurrency.

It supports a range of coins, including Bitcoin (BTC), Ether (ETH), Dogecoin (DOGE), and Litecoin (LTC).

This makes it far easier for traders to diversify their portfolios and access new markets.

You can also move your funds between your Robinhood Crypto and Robinhood Financial accounts quickly and securely.

5. Easy to Create Accounts.

The only requirements to create a Robinhood account are to fill out a few forms, fund your account, and you’re ready to start trading.

The process takes less than 10 minutes, so it’s quick and easy for new investors to start.

Yes, you have to verify a few details, but overall it’s a painless procedure.

Disadvantages of Robinhood

Just like any platform, Robinhood also comes with a few drawbacks.

Before you sign up for an account, make sure to consider the following:

1. Average Customer Service.

Being one of the top trading platforms in the world, Robinhood has an extensive customer support team.

However, due to its large user base and high volume of queries, it can take longer than expected to resolve your issue.

You may have to wait longer than you’d like for a response.

2. Bonds and Mutual Funds are Not Available.

Bonds and mutual funds are some of the most common types of investments.

Unfortunately, Robinhood does not support these options.

So if you want to diversify your portfolio with these investments, you’ll have to look elsewhere.

But you still have a wide range of stocks and options.

3. Limited Research and Analysis Tools.

One of Robinhood’s main downsides is its limited research and analysis tools.

While it does offer some basic charting capabilities and a few other features, they are less comprehensive than what you would find on other platforms.

You must also pay $5 monthly for access to advanced charting and analytics tools – free on other platforms.

Frequently Asked Questions on How to make money from Robinhood

Is trading on Robinhood risk-free?

No, trading on Robinhood, like any investment platform, carries inherent risks. The value of investments can fluctuate, and there’s always a possibility of losing money.

What are some common strategies for making money on Robinhood?

Common strategies include buying and holding stocks for the long term, day trading, swing trading, investing in dividend-paying stocks, and exploring options trading.

Do I need a lot of money to start investing in Robinhood?

No, you can start investing in Robinhood with a relatively small amount of money. The platform allows you to buy fractional shares, which means you can invest in companies with as little as one dollar.

What is the difference between investing and trading on Robinhood?

Investing in Robinhood typically involves a long-term approach, where you buy and hold assets with the expectation that they will appreciate over time. Trading, on the other hand, often involves more frequent buying and selling of assets to capture short-term price movements.

How can I stay informed about market trends and investment opportunities on Robinhood?

You can stay informed by using the tools and resources provided by Robinhood, such as market news, stock screeners, and analysis. Additionally, you can explore external sources of financial news and analysis.

Final Thoughts on How to make money from Robinhood

So there you have it!

Robinhood is an outstanding stock and cryptocurrency trading platform with no commissions, modern technology, and an easy-to-use interface.

You will have many options how to make money on Robinhood, but it has drawbacks.

Make sure to research and consider the pros and cons before you sign up for an account.

Good luck!